Debt Collection System (TERA COLLECT)

Traditional Debt Collection Poses 4 Distinct Challenges

1. Locating Delinquent Debtors

Debtors often change their contact information, move residences, or even deliberately conceal their whereabouts to avoid repayment. Finding them becomes a complex task, requiring extensive resources and advanced techniques to track down and initiate the collection process.

2. Balancing Recovery and Customer Relationships

Debt collection efforts can strain the delicate balance between recovering debts and maintaining positive customer relationships. Your team must navigate this challenge by employing tactful and respectful communication methods that preserve customer trust while still pursuing the debts. Striking the right balance between assertiveness and sensitivity is vital to protect your institution’s reputation and ensure long-term customer satisfaction.

3. Data Management and Integration

Your credit department often has vast amounts of customer data scattered across various systems and databases. Consolidating and integrating this data to create a comprehensive view of a debtor’s financial situation can be a time-consuming and challenging process. The ability to access and analyze accurate and up-to-date data is crucial for making informed decisions and developing effective collections strategies.

4. Lack of built-in analytics

Your current collection system is probably lacking features to score and analyze accounts. Without these analytics, you can’t determine a consumer’s willingness and ability to pay, which hinders prioritization. You end up wasting time on debtors who may never pay up, instead of focusing on those that constitute low-hanging fruit.

But don’t worry…

A Debt Collection System Built for Every Stage of Your Collections Workflow

Harnessing the potential of data and leveraging advanced analytics, our debt collection system surpasses the constraints imposed by your in-house resources, creating an optimized environment that spans your entire collections workflow.

The system:

- Streamlines and automates your collection process, reducing costs you incur in the collection process

- Has an enhanced reporting module

- Has improved self-cure rates due to automated reminders defined by the number of delinquency days.

- Enables your team to set measurable targets for both internal and external collectors

- Reduces turn-around time from initial delinquency to settlement.

- Has the ability to measure attempts to contact debtors

- Employs machine learning algorithms to predict best time to contact debtors, thereby increasing payment success rates.

- Boosts efficiency and productivity in your debt collection operations.

- Increases the likelihood of successful debt recovery with streamlined processes.

- Improves debtor communication and transparency.

- Reduces manual efforts and minimizes errors.

- Enhances your compliance with debt collection regulations.

- Optimizes resource allocation and prioritizes high-value accounts.

- Provides valuable insights through comprehensive reporting and analytics.

Our goal is to help you maximize the recovery of bad debts while minimizing your resource expenditure, all while adhering to compliance policies and legal regulations.

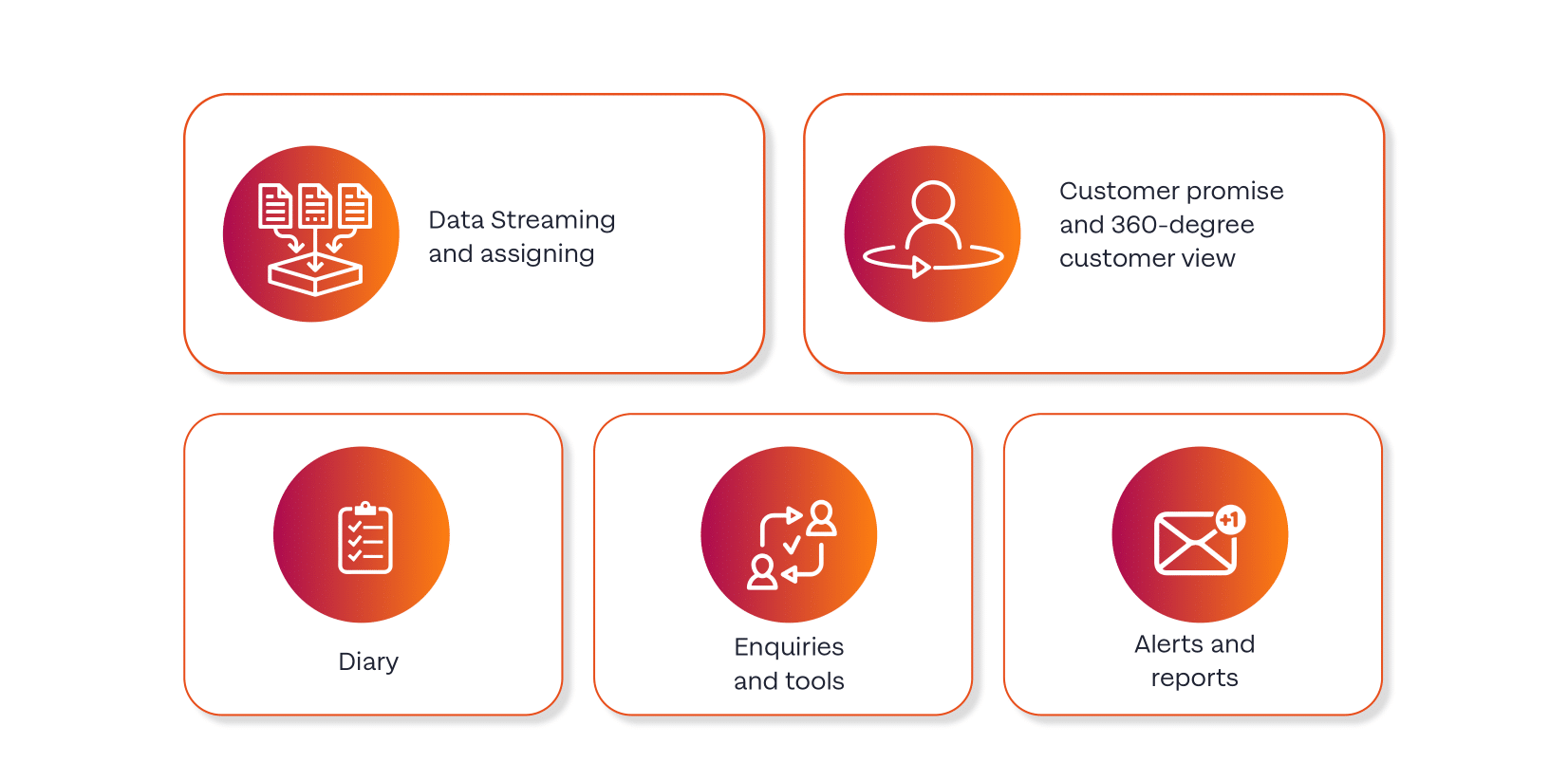

Tera Collect Has 5 Powerful Modules

- Data upload & Assignment

Data Upload: Loan-related data from the core system is synced to give a 360-degree view of the customer and collection status. Mass data from different sources e.g., loan details, Guarantor and Repayment can be synchronized with a single click no need for and in real time. - Diary

Diary module enables Tera collect to analyze the promises that are due on that day or the previous day to allow for follow-up on whether the payments were received or not. An email is sent to the Debt officer every morning based on the promises made under his/her portfolio. - Enquiries and Tools

Enquiry

This module enables you to view the assigned and uploaded data for reference. The solution has various enquiry modes which help you to narrow a search through various sets of tabs and manual criteria entries.- Workload Enquiry

- 360 customer Enquiry

- 360 customer promise Enquiry

Tools

Tools are special initiatives that enable you to take data from the multiple sources, and combine to view the required data in a specific format. The solution is easily customizable and can be tailored to enable design and incorporation of more tools, based on your requirements.

- Customer Details Search Tool

- Customer Promise Details Tool

- Debt Officer Performance Review Tool:

Customer Promise and 360 Degree View: Allows a complete all-round view of the customer:

- Payments

- Guarantor(s)

- Basic Details

- Alerts & Notifications

Tera Collect has inbuilt alerts notification system that delivers notifications through Email, SMS and system pop-ups. It gives you the peace of mind that nothing is going on unnoticed. The system generates alerts for all important activities as and when they happen, such as a broken promise, missing information, among others. - Customer Promise and 360 Degree View

This sub-module enables you to record customer payment promises that facilitate reminders to both your customer as well as debt officer through and auto-generated mail. Here’s how you get to achieve this:- Each customer promises are recorded with a time stamp.

- Multiple customer promises with different IDs can be committed by the different debt officers

- Payment is tracked against the customer promises

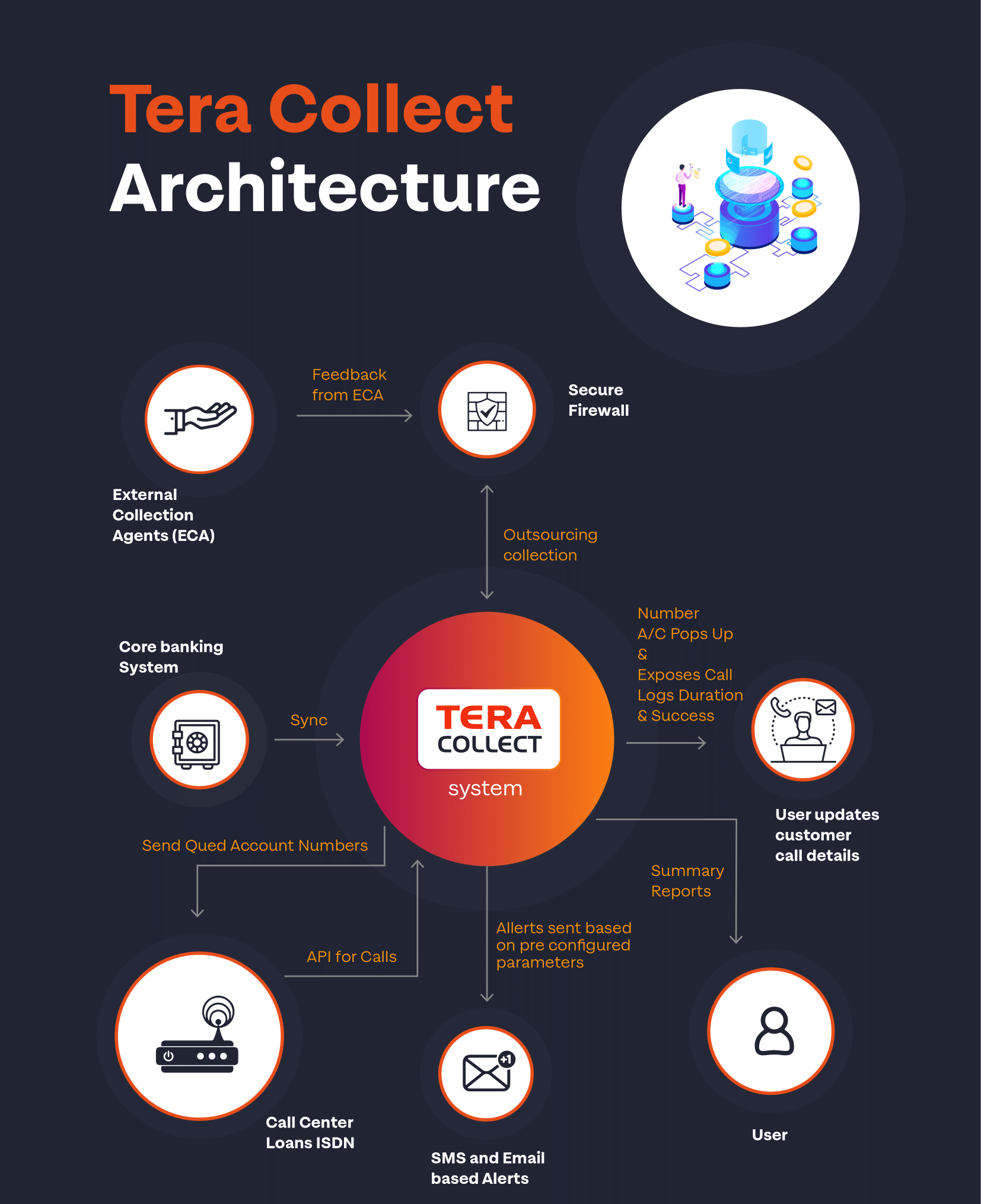

Simple Architecture with Key Robust Features

Robust Features To Ease Your Collections

- Escalation functionality

- Contact and locate

- Workflow and Rules

- Analytics

Escalation functionality

For situations where a loan facility is moving to a different bucket without any collection activity, the system allows you to escalate the activity to higher levels for further action. For instance, you can escalate an overdue loan to the supervisor where a customer is unresponsive or giving no commitments on repayments.

Contact and locate

With accurate, current and complete data for skip tracing and contacting consumers, including phone numbers, addresses, email, employers, relatives, associates and more, you can use this information and the multiple avenues Tera Collect provides to contact debtors for collections and connect with them before other debt collectors do.

Workflow and Rules

The debt collection system fully automates assigning of debt officers to the individual customer. This happens in real time based on configurations in the officer’s setup bucket and profile you’ve laid out. Pre-defined system rules automatically allocate customer to the relevant debt officer.

Analytics

The system enables you to gain deeper insights beyond credit reports. You can effectively segment accounts, prioritize resource allocation and pursue consumers who are more likely to pay first. Consider factors such as urgency, optimal collection strategies, and other relevant criteria.

Our Latest Announcement Brings an Exciting Evolution!

Tera Collect’s latest Version 4 (GamaUI) provides a new suite of features, including Icon Standardization, Structural Optimizations, Field Alignments, Augmented Dashboard, Uniform Toolbar, Secure Browser login, Application Screen Manuals, and many more.

Maximize Debt Recovery with NLS Debt Collection Solution!

Speak with an Expert Today to schedule a demo or request more information.